Introduction to Home Insurance

Home insurance is a type of financial protection that helps you cover costs if something bad happens to your home. It’s like having a safety net for your house. This insurance is important because it can help you repair or rebuild your home if it gets damaged, replace your belongings if they are stolen or damaged, and even cover legal expenses if someone gets hurt on your property.

Coverage Types

- Dwelling Coverage

Dwelling coverage helps pay for repairs or rebuilding your home’s structure, like walls and roofs, if they are damaged by covered events like fire or storms. - Personal Property Coverage

This coverage helps replace or repair your belongings, such as furniture, electronics, and clothes, if they are stolen or damaged by covered events. - Liability Coverage

Liability coverage helps protect you financially if someone is injured on your property and you are found responsible. It can cover legal fees and medical expenses. - Additional Living Expenses Coverage

If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary living expenses like hotel bills or rent.

Redirecting to https://totalwebdisaster.co.uk/health-insurance-explained-benefits-and-coverage/ in 55 seconds…

Perils Covered

Home insurance typically covers common perils like fire, theft, vandalism, windstorms, and certain types of water damage. It's important to review your policy to understand exactly what is covered and what is not.

Exclusions

While home insurance covers many situations, it usually excludes certain events like floods and earthquakes. Separate policies are available for these types of risks.

Understanding Deductibles

A deductible is the amount of money you agree to pay out of pocket before your insurance kicks in. Higher deductibles often mean lower premiums, but you'll pay more if you make a claim.

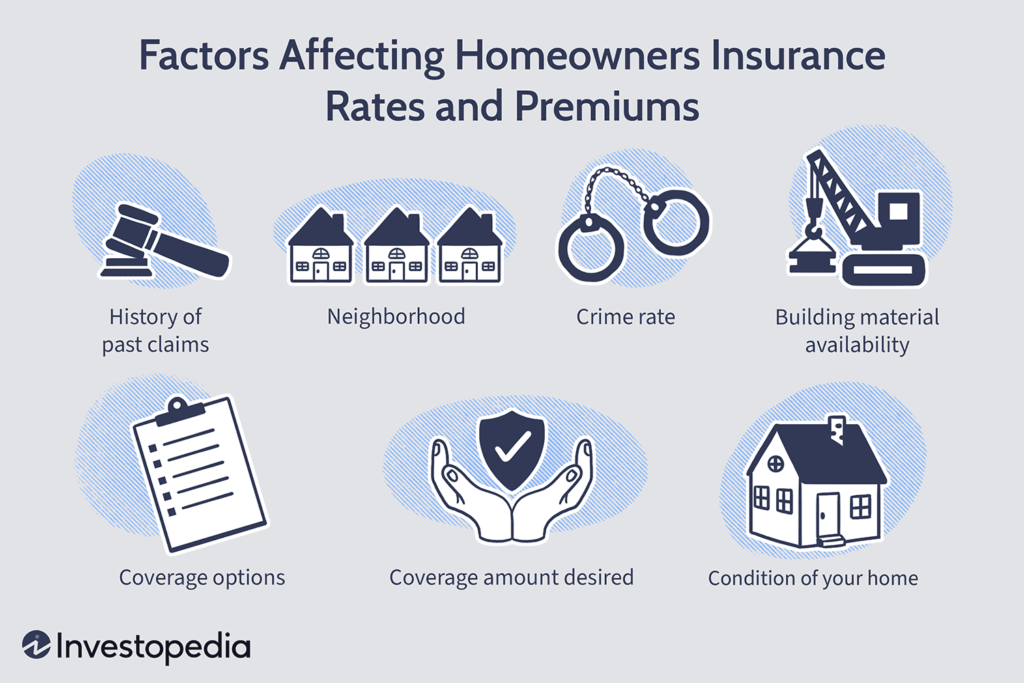

Tips for Choosing Home Insurance

- Assess your coverage needs based on your home's value and contents.

- Compare quotes from multiple insurers to find the best coverage at a good price.

- Review policy details carefully, including coverage limits, deductibles, and exclusions.

Conclusion

Home insurance is a valuable tool for protecting your home and finances from unexpected events. Regularly reviewing your policy and staying informed about your coverage can help ensure you have the protection you need.